A New Way to Invest: Strong Enthusiasm for Diversified Investing

In addition to offering single-asset Series, StartEngine’s diversified Funds provide exposure to multiple VC-backed companies with a single check. StartEngine has launched six Funds to date, five of which sold out.

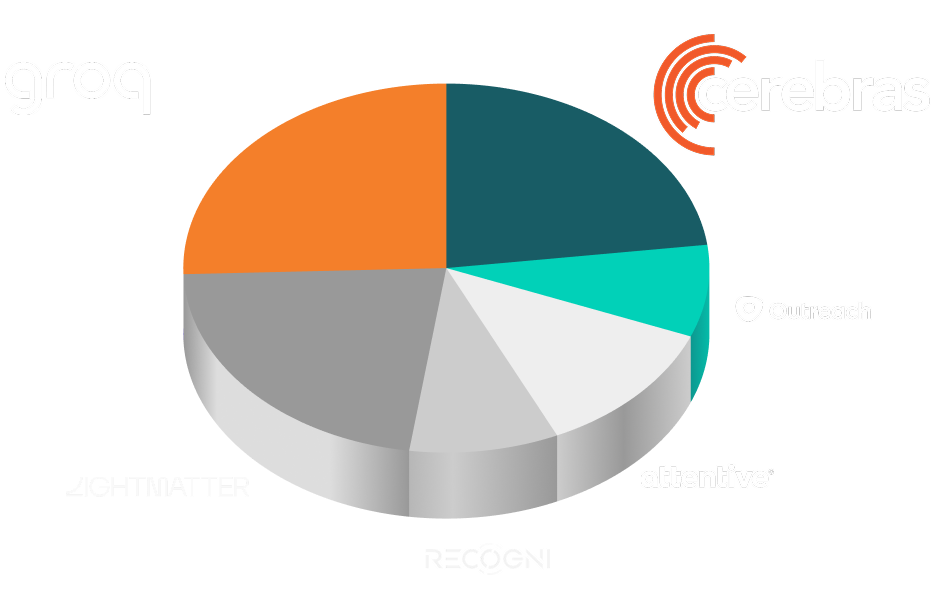

For example, the chart below shows a breakdown of our A.I. Chip Fund, which provided exposure to six private companies, with a single, low minimum investment.⁴

.png)