1.

Count determined as number of unique email addresses in StartEngine’s database as of 04-03-2025. One individual may have more than one email address. In May 2023, StartEngine acquired assets of SeedInvest, including email lists for SeedInvest’s users, investors and founders. Click here for more details. Amount invested includes $470M in funds raised previously through offerings conducted on www.seedinvest.com outside of the StartEngine platform.

2. Based on our

Q3 2025 Form 10-Q/A. This revenue growth has been driven by StartEngine Private, a new product line that offers funds in late stage companies. This product line has driven over $75.9 million of the $92.7 million in revenue from the first 9 months of 2025. To understand the impact on margins,

see financials. Past performance may not be indicative of future performance.

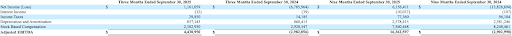

We define Adjusted EBITDA as net income (loss) calculated in accordance with GAAP adjusted to exclude interest expense, interest income, income taxes, depreciation, and amortization, and stock based compensation. We present Adjusted EBITDA because it is a key measure used by our management team to evaluate our operating performance, generate future operating plans and make strategic decisions. We believe Adjusted EBITDA provides useful information to investors regarding our operational performance and our ability to generate cash flows. Non-GAAP information should be considered as supplemental in nature and is not meant to be considered in isolation or as a substitute for the related financial information prepared in accordance with GAAP. In addition, our non-GAAP financial measures may not be the same as or comparable to similar non-GAAP financial measures presented by other companies.

The following table reconciles net income (loss), the most directly comparable U.S. GAAP measure, to Adjusted EBITDA for the periods presented:

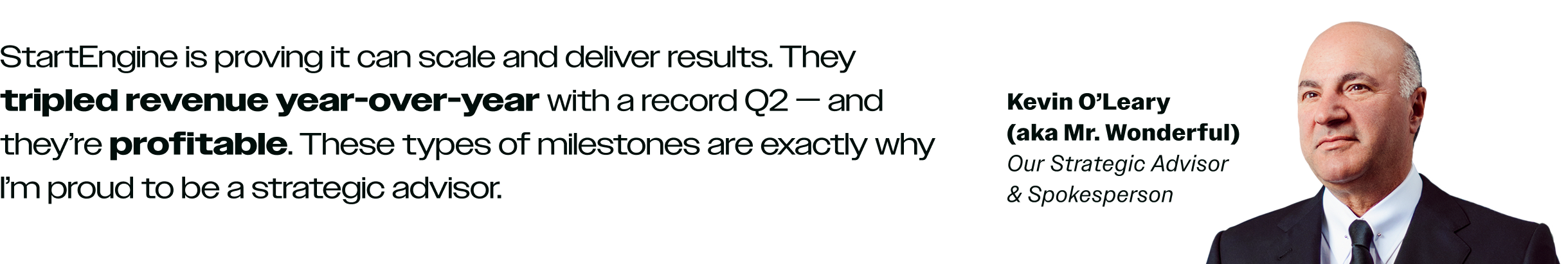

3. Kevin O’Leary is a paid spokesperson for StartEngine. See his 17(b) disclosure,

here.

4. The underlying companies held by StartEngine Private Funds LLC, and StartEngine Private LLC (together, “StartEngine Private”) are not participating or involved in the offering. The availability of company information does not indicate that the company has endorsed, supports or otherwise participates with StartEngine Private or any of its affiliates. StartEngine Crowdfunding LLC purchases shares from current and former employees, early investors, and advisors of the companies and sells the shares to StartEngine Private for each offering. When you make an investment in a company on StartEngine Private, you are purchasing an interest in a series of StartEngine Private Funds LLC or StartEngine Private LLC, each a Delaware limited liability company (together the “Series LLCs”), which were created to hold shares of privately held companies. An investor will not directly own or hold shares of the private company but instead will own member interests in a series of the Series LLCs, which either directly or indirectly, will hold shares in the company. There may not be a one-to-one economic parity on the value of the Series LLCs interests and the underlying shares.

5. News Sources: Reuters Staff, “

Charles Schwab to Buy Private Shares Platform Forge Global in $660 Million Deal,” CNBC, November 6 2025; Leo Almazora, “

Morgan Stanley to Acquire EquityZen, Expanding Access to Private Shares,” InvestmentNews, October 29, 2025; Liz Napolitano, “

BlackRock-Linked Tokenization Firm Securitize to Go Public via SPAC Deal,” CNBC, October 28, 2025; Anas Hassan, “

Trump Memecoin Issuer Eyes Republic Acquisition to Enter Startup Funding,” Cryptonews, October 30, 2025Revenue Sources: ZoomInfo, “

Republic Overview,” Web Page, Accessed November 13, 2025; Forge Global, “

CORRECTING and REPLACING Forge Global Holdings, Inc. Reports Second Quarter Fiscal Year 2025 Results,” Press Release, August 1, 2025; Securitize’s H1 2025 revenue sourced from a confidential report and reviewed by StartEngine; ZoomInfo, “

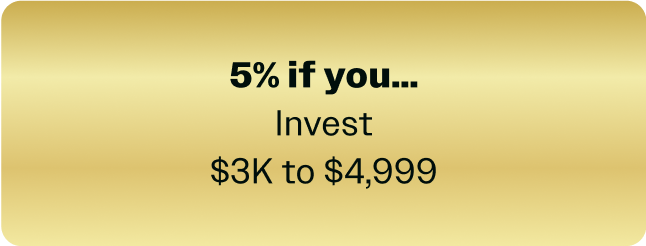

EquityZen Overview,” Web Page, Accessed November 13, 2025; 6. StartEngine receives 1% equity in fees from many of our crowdfunding offerings, and 20% carried interest in some of our Private pre-IPO offerings. There is no guarantee that the 20% carried interest or equity received as compensation will have value, that they will generate income for StartEngine, or that the company will be profitable.7. Investors in StartEngine can receive up to 20% total bonus shares based on certain criteria:Perks Terms & Conditions10% if you reserved shares during the latest Test the Waters phase10% if you are a member of the Venture Club. Members get 10% on all investments in eligible offerings for an entire year for an annual fee of $275. This can be purchased at checkout.5% if you invest between $3,000 and $4,999.9910% if you invest between $5,000 and $24,999.9920% if you invest $25,000 or more.Bonus shares in this offering are stackable. The maximum amount of bonus shares that an investor can receive is 20%. Any investor who falls into two of the three categories above will receive 20% bonus shares, as will anyone who falls into all three categories. For example, if an investor reserved shares in StartEngine and is a Venture Club member, they will receive 20% additional shares. If that person also invests over $25,000, they will still receive the maximum of 20% bonus shares. Bonus shares may not immediately appear on your investor dashboard, but will be issued prior to the offering closing.In order to receive perks from an investment, one must submit a single investment that meets the minimum perk requirement.If you are investing via a self-directed IRA, you cannot receive additional perks beyond bonus shares due to tax laws.

THIS WEBPAGE MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

***

ABOUT

HEADQUARTERS

4100 W Alameda Ave., 3rd Floor

Burbank, CA 91505

StartEngine is the alternative investing platform that provides exclusive venture-backed deals representing exposure to Perplexity, Databricks, and more. Based on our unaudited Q2 2025 financials, our revenue tripled YoY to a record $39M and $3.2M GAAP net income ($6.7M adjusted EBITDA), see footnote 1. Now you can join 50,000+ shareholders and change the future of finance. Past performance may not be indicative of future performance.